PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Tenir les marchés mondiaux entre vos mains

Notre application de trading pour mobile est compatible avec la plupart des appareils intelligents. Téléchargez l’application dès maintenant et commencez à trader avec PU Prime sur tout appareil, à tout moment et en tout lieu.

Just as with most forms of investing and trading, taking note of the trading hours in the forex market is everything in Forex trading. Grasping the right hours in the day to trade, knowing the dates of important economic announcements, and just timing your trades correctly will give you an edge, and significantly increase your chances of making a profit.

While the Forex market operating 24/5, it would be impossible to monitor the market 24 hours a day, even for a full-time trader. Instead, it is much more efficient to know the different trading sessions around the globe and align your trading goals and plans with the characteristics of each session.

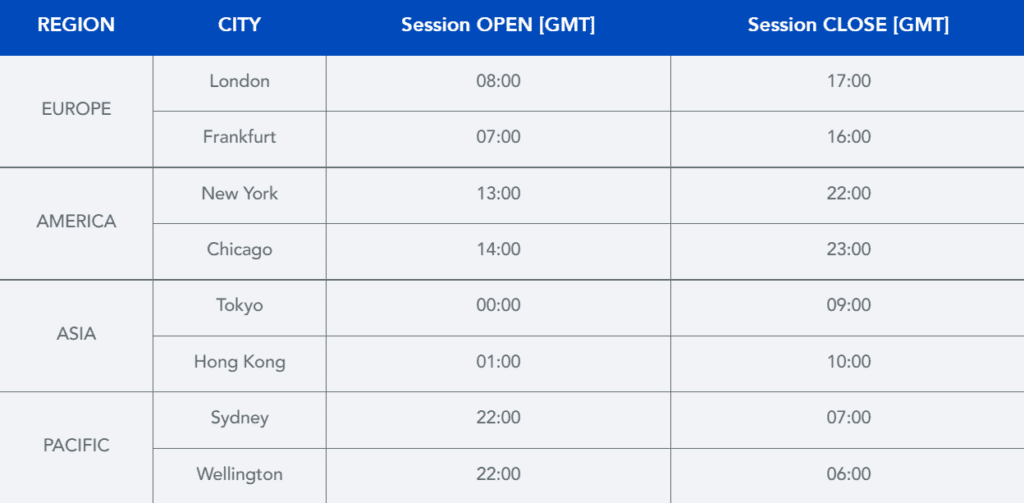

Forex runs 24 hours a day thanks to its decentralised nature, which allows each of the different major markets – London, New York, Tokyo, and Sydney – to cover different hours of the day, as shown in the chart below:

However, not every session presents the same opportunities. For example, London is the largest Forex market in the world, accounting for roughly 35-40% of all trading in the world.

This is followed by New York, which is also important because the US dollar is involved in an overwhelming majority of trades. Because of this, FX investors closely follow any news regarding the American economy. This includes any releases by the Federal Reserve or major activities on the New York Stock Exchange.

Consequently, the period of overlap between the New York and London trading sessions, which happens from 13:00 – 17:00 GMT, is usually when there is the most volatility and liquidity in the market. Spreads are usually at their lowest during this time too, so it’s a good time to be trading.

However, it also pays to monitor other sessions depending on your trading plan. Any trading involving the Japanese yen will also benefit from a close watch on the Japanese session, which runs from 00:00 – 09:00 (GMT) as the Bank of Japan has a very large influence on its market.

Meanwhile, the Sydney session also holds some weight as it is the first market to open for the week at 22:00 on Sunday, when traders will be looking to get back in after the weekend break.

If you are using a leading forex trading like PU Prime, your broker should state the trading hours available for forex pairs on its product page.

As we’ve mentioned before, it’s important to treat Forex trading like running a business. This means properly managing your resources, which includes time and energy. Wisely allocating your trading time can prevent burnout, which might cause you to make mistakes.

As we’ve covered in our breakdown of fundamental analysis, world events and official releases of economic data can have a profound effect on the movement of prices in the Forex markets. This is why traders closely monitor economic calendars, which list events like central bank meetings and releases of economic data.

Just like with the Forex sessions, not all data released is equally significant. A large amount of information is released each day, and it pays to know which the important ones are. Most economic calendars will give an indicator, but it also helps to know what each event is, so you can decide if and how the data will affect the currencies that you are trading.

Some important releases include:

All the releases listed above will have visible and immediate impact on the Forex markets, especially if they out- or underperform analyst estimates. Economic growth will strengthen a country’s currency, while volatility will usually strengthen hedging assets like gold. Some countries’ currencies are also closely correlated to commodities, like the Canadian and Australian dollar.

Want to be a successful trader? Then remember to have a disciplined schedule, take breaks, and keep a clear mind. Like the saying goes, trade smart, not hard.

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.