-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

*Fed Chair Jerome Powell reaffirmed the path toward rate cuts, emphasizing a cooling labor market and bolstering expectations for easing in October and December.

*News of a diplomatic breakthrough ending the Israel-Hamas conflict further improved investor confidence, reinforcing a risk-on market tone.

*Trump’s criticism of China over stalled U.S. soybean imports reignited trade concerns, posing a potential headwind to the current optimism.

Market Summary:

Financial markets were shaped by key statements from two pivotal U.S. figures yesterday, fostering a distinct risk-on tone. Federal Reserve Chair Jerome Powell, speaking in Philadelphia, struck a notably dovish chord. While acknowledging that recent economic data preceding the government shutdown and auto strikes had outperformed expectations, he emphasized that the overall outlook remains consistent with the Fed’s last meeting. Crucially, he highlighted a cooling labor market and reiterated that the trajectory for interest rate cuts remains on track, signaling a central bank focused on supporting employment. This guidance has solidified market expectations, with pricing now indicating a high probability of a rate cut in October, followed by another in December. These dovish prospects provided a fundamental cushion for equity markets facing underlying downward pressures.

The constructive sentiment was further amplified by a social media post from the U.S. President, who celebrated a diplomatic engagement that ended the Israel-Hamas war. The mitigation of this key geopolitical risk contributed to the improvement in investor appetite, compounding the positive effect of the Fed’s accommodative stance.

However, this optimistic backdrop is being challenged by renewed trade friction. Former President Donald Trump publicly condemned China for not importing U.S. soybeans and suggested a retaliatory move from the White House is being prepared. This rhetoric introduces a significant element of uncertainty, threatening to escalate tensions between the two economic giants and potentially hindering the market’s forward momentum.

Technical Analysis

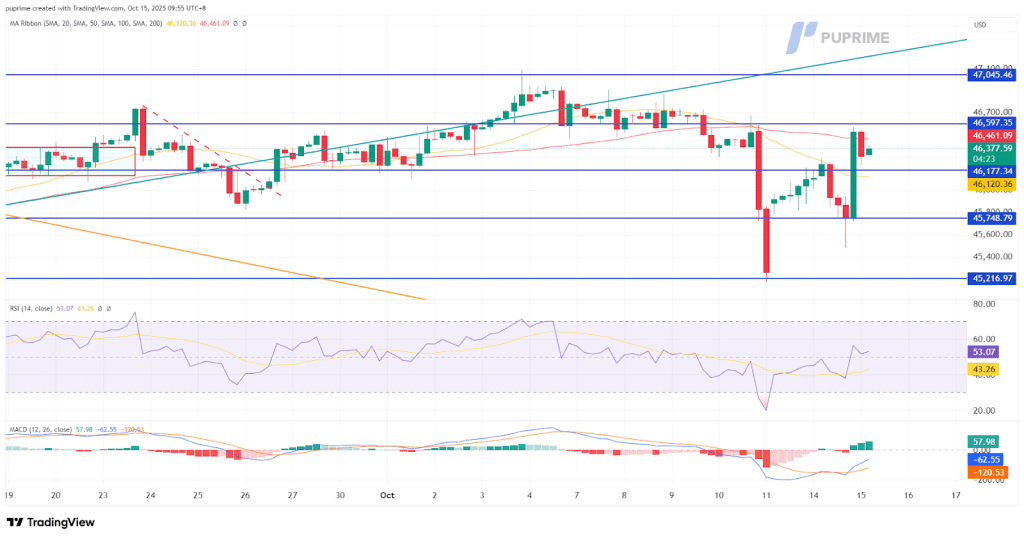

The Dow Jones Industrial Average staged a robust recovery in the last session, rallying nearly 800 points after finding strong support at the 45,740 level. This significant rebound has now propelled the index to challenge a key technical hurdle at the 46,600 resistance mark.

A decisive break above this 46,600 level would be a critical technical development, potentially invalidating the index’s recent bearish structure and signaling a shift to a bullish near-term bias.

The bullish case is supported by a notable shift in momentum indicators. The Relative Strength Index (RSI) has rebounded from oversold territory, while the Moving Average Convergence Divergence (MACD) has triggered a bullish ‘golden cross’—though it remains below its zero line. This confluence suggests the previous bearish momentum is decisively easing, creating conditions conducive for a potential trend reversal. The index’s near-term trajectory now hinges on its ability to convert the 46,600 resistance into a new support base.

Resistance Levels: 46,600.00, 47,050.00

Support Levels: 46,180.00, 45,750.00

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.