-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

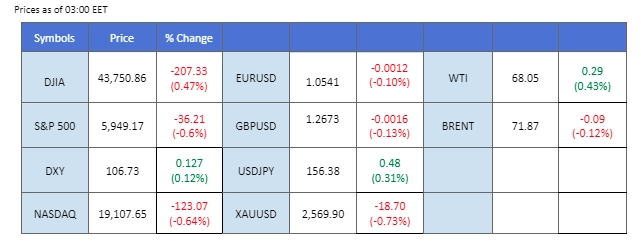

Market Summary

The spotlight was on the U.S. job data yesterday, with the dollar strengthening following the upbeat Initial Jobless Claims, which came in at their lowest level since May. This suggests a resilient job market, potentially leading to stickier inflation and increasing the likelihood of a more hawkish Fed stance in the upcoming monetary policy decisions. As a result, the dollar is expected to continue strengthening in the near future.

In contrast, riskier assets such as equities and cryptocurrencies were weighed down by expectations of tighter Fed policy. Wall Street saw a significant decline, while the crypto market also edged lower.

The Japanese Yen remains lacklustre after disappointing Japanese GDP data was released in the Tokyo session, signalling economic weakness and diminishing the prospects for monetary tightening by the BoJ.

Traders should keep an eye on the UK’s GDP reading today, as it could have a significant impact on the Pound Sterling and market sentiment regarding the UK’s economic outlook.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (32.2%) VS -25 bps (67.8%)

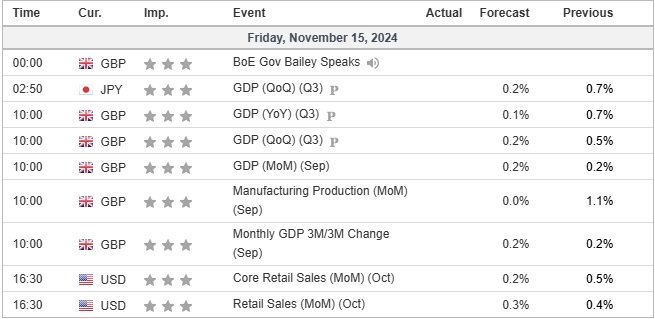

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index continued its upward momentum, gaining over 1.8% this week, reflecting a bullish trend supported by strong U.S. economic data. The dollar was buoyed by the latest initial jobless claims, which reached their lowest level in May, signalling continued labour market resilience. Adding to this optimism, the Fed commented on the robust U.S. economic performance, hinting that while rate cuts may still be on the table, they may proceed at a slower pace and reduced size. This cautious approach suggests that the Fed may prioritise economic stability, lending further support to the Dollar’s strength in the near term.

The Dollar Index is approaching another resistance level at the 107.00 mark; a break above shall be a bullish signal for the index. The RSI remains close to the overbought zone while the MACD continues to edge higher, suggesting the bullish momentum remains strong with the index.

Resistance level: 107.10, 107.80

Support level: 106.20, 105.60

Gold prices saw a slight rebound from recent lows, signaling a technical correction; however, the precious metal remains below previous highs, indicating a continued downtrend. Should gold continue to face selling pressure, it is anticipated to find strong support around the $2,530 level, a key level that could potentially provide stabilisation for the asset. Traders are advised to monitor this support zone, as a break below may signal further downside momentum, while a hold could suggest consolidation within the current range.

As the gold remains trading in a downtrend trajectory, should the gold once again drop below the $2550 mark, it may be a bearish signal for the gold. The RSI remains close to the oversold zone while the MACD continues to edge lower, suggesting the bearish momentum remains intact with the gold.

Resistance level: 2605.00, 2660.00

Support level: 2525.00, 2485.00

The GBP/USD pair saw notable fluctuations in the last session, heavily influenced by recent U.S. economic data. However, the pair remains near its recent lows, signaling a sustained bearish trend. Bank of England (BoE) Governor’s recent comments highlighted concerns over weak economic growth in the UK, suggesting a potential shift toward a more dovish policy stance. Traders should also anticipate increased volatility in the British Pound, with the UK’s GDP report set for release today, which may provide further directional cues for the pair depending on whether growth meets, exceeds, or falls short of expectations.

GBP/USD, despite easing from its bearish momentum but remains trading in a downtrend trajectory. The RSI remains in the oversold zone while the MACD continues to edge lower, suggesting that the pair will continue trading with a bearish momentum.

Resistance level: 1.2678, 1.2750

Support level: 1.2610, 1.2540

The EUR/USD pair dipped below the 1.0500 mark for the first time in a year, continuing its bearish momentum and suggesting a sustained downside bias. The euro has been under pressure from disappointing economic indicators, notably the Industrial Production data, which contracted by 2.0%, despite the GDP reading aligning with market expectations. Additionally, the pair is facing further headwinds from the strengthening U.S. dollar, which continues to bolster the bearish outlook. Should the dollar maintain its strength, EUR/USD may continue its downward trajectory.

The EUR/USD remains trading at its recently low level, suggesting a bearish bias for the pair. The RSI remains close to the oversold zone while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 1.0570, 1.0623

Support level: 1.0470, 1.0409

The USD/JPY pair reached a new high in the recent session and is approaching a key resistance level around the 157.50 mark. The Japanese GDP data, released during the Tokyo session today, came in weaker than expected, which suggests that Japan’s economic conditions may delay further monetary tightening by the BoJ. This has put additional pressure on the Japanese Yen, allowing the USD/JPY pair to maintain its bullish momentum. Should the pair break above the 157.50 resistance level, it could signal further upside potential for the dollar against the yen.

The USD/JPY pair remains trading in its uptrend trajectory, with the bullish momentum seemingly strong. The RSI has broken into the overbought zone while the MACD continues to climb, in line with a strong bullish momentum.

Resistance level: 157.50, 160.00

Support level: 153.75, 151.35

The Nasdaq was impacted by a shift in sentiment across Wall Street, as strong U.S. economic indicators raised expectations of a more hawkish approach from the Federal Reserve. This has weighed on the riskier assets, with equity markets facing downward pressure. The U.S. stock market is set to close the week lower after a period of optimism fueled by the “Trump trade” euphoria. The prospect of a more aggressive Fed in response to solid economic data has dampened investor enthusiasm, particularly for tech-heavy indices like the Nasdaq, which are more sensitive to higher interest rates.

The Nasdaq is expected to fill the gap to the 20800 mark that was incurred last week. The RSI has eased, and the MACD is set to cross on the above, suggesting the bullish momentum is easing.

Resistance level: 21,100.00, 23,000.00

Support level: 20,570.00, 19,860.00

Oil prices attempted a breakout from their recent consolidation range but failed to hold above this level, suggesting a potential false breakout. This move reflects bearish sentiment, fueled by higher-than-expected U.S. stockpile data, which indicates continued weak demand domestically. Additionally, the hawkish stance of the Federal Reserve has weighed on the near-term outlook for oil, as rising interest rates could dampen economic activity and reduce energy demand. Traders should remain cautious, as these fundamental pressures may subdue oil prices in the sessions ahead.

Oil prices remain ranging and give a neutral signal for the oil prices’ upcoming price movement. The RSI has rebounded from the oversold zone while the MACD has a golden cross below, suggesting the bearish momentum is vanishing.

Resistance level: 69.85, 72.55

Support level: 67.10, 65.50

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.