-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

Synthèse du marché

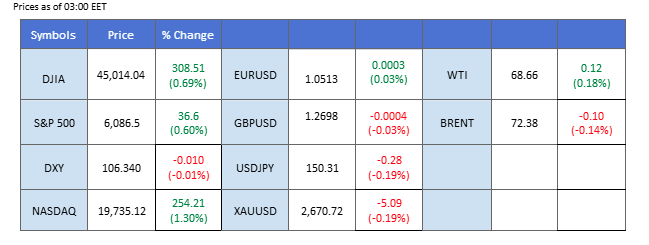

The euro traded largely unchanged after the French government was ousted in a no-confidence vote led by far-right leader Marine Le Pen. The anticipated outcome saw Prime Minister Élisabeth Borne lose parliamentary support, casting uncertainty over the next chapter of French politics, which may weigh further on the euro.

Meanwhile, the U.S. dollar experienced a volatile session. Initially pressured by weaker-than-expected ADP Nonfarm Employment Change data and disappointing PMI readings, the greenback rebounded as Fed Chair Jerome Powell struck a confident tone, asserting that the U.S. economy remains more resilient than previously forecasted, even after recent rate cuts. His comments buoyed both the dollar and Wall Street sentiment. In the Japanese Yen market, downside pressure mounted as expectations for a Bank of Japan rate hike in December fell from 66% to 44%, diminishing the currency’s appeal.

In the commodity market, The precious metal traded in a narrow range as traders awaited Friday’s Nonfarm Payrolls report, a key indicator for the Fed’s monetary policy trajectory. On the other hand, Crude prices plunged over 2% amid bearish sentiment. U.S. crude stockpiles saw a larger-than-expected build, adding to pressure ahead of the OPEC+ meeting, where the market anticipates discussions on extending production cuts.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 18 décembre Décision de la Fed sur les taux d'intérêt:

Source : Outil Fedwatch du CME

0 bps (40.4%) VS -25 bps (59.6%)

(Heure du système MT4)

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

The Dollar Index remained flat as market participants digested statements from Fed Chair Jerome Powell and awaited Friday’s critical US jobs report. Powell highlighted the need for a cautious approach to rate cuts, emphasizing that the resilient US economy does not warrant aggressive monetary easing. The outlook for dollar trends hinges on upcoming economic data, leaving investors on edge for more clues.

The Dollar Index is trading flat while consolidating between support and resistance levels. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the index might still struggle to seek direction since the RSI stays near the midline.

Niveau de résistance : 106,85, 108,05

Niveau de support : 105.80, 104.45

Gold prices remained flat, consolidating within a narrow range as investors maintained a cautious outlook amid mixed market sentiment. Renewed tensions in the Middle East, particularly Israel’s ongoing strikes against Hezbollah despite the ceasefire agreement, have fueled safe-haven demand for gold. However, this bullish momentum was capped by the stronger-than-expected US job openings data, which bolstered the dollar and curbed gold’s appeal.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the commodity might edge lower since the RSI stays below the midline.

Resistance level: 2650.00, 2705.00

Support level: 2610.00, 2550.00

The GBP/USD pair is trading close to its recent high of 1.2725, supported by better-than-expected UK PMI readings, which boosted optimism about the British economy. Weak U.S. economic indicators released yesterday added to the pair’s upward momentum, providing additional relief for the Pound Sterling. However, gains remained tempered as market sentiment shifted following hawkish remarks from Federal Reserve Chair Jerome Powell. His statement, emphasizing the resilience of the U.S. economy, lent renewed strength to the greenback, limiting further upside for the pair.

The GBP/USD is currently hovering at its recent peak and is awaiting for fresh bullish momentum to break another high. The RSI remain above the 50 level while the MACD hovering flat close to the zero line, suggesting that the bullish momentum is lacking.

Niveau de résistance : 1,2790, 1,2850

Support level: 1.2620, 1.2505

The EUR/USD pair remains muted as markets closely monitor the unfolding political crisis in France. The ruling party faced a no-confidence vote, leading to the ousting of the Prime Minister by the opposition. This political upheaval has injected uncertainty into the eurozone, keeping the euro largely flat as traders await clarity on the situation. With sentiment cautious, the pair shows limited movement, suggesting that investors are adopting a wait-and-see approach until the political outlook in France becomes clearer.

The pair is traded sideways with lack of direction. The RSI hovered close to the 50 level while the MACD flowed in between the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.0607, 1.0680

Niveau de support : 1.0440, 1.0325

The USD/JPY pair breached its short-term resistance level at 150.80 but encountered notable selling pressure at this threshold. The Japanese yen weakened following a shift in market sentiment, with speculation around a December rate hike by the Bank of Japan waning. The probability of a rate increase has dropped sharply to 40% from 66%, eroding support for the yen. Meanwhile, the dollar gained momentum after hawkish remarks from Federal Reserve Chair Jerome Powell, who emphasized the resilience of the U.S. economy.

The USD/JPY pair has eased from its bearish momentum and has formed a higher-high price pattern, suggesting a potential trend reversal for the pair. The RSI has rebounded while the MACD has a golden cross and is moving toward the zero line from below, suggesting that the bearish momentum is widely easing.

Resistance level: 151.70, 154.00

Support level:149.35, 146.45

The US equity market continued its positive trajectory, with Wall Street hitting record highs as confidence in the tech sector surged. Strong earnings from Salesforce Inc., which jumped 11%, and ongoing momentum in NVIDIA Corporation further buoyed the Nasdaq Composite. Powell’s comments on the strong economic backdrop added optimism, suggesting a tempered pace of rate easing.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 79, suggesting the index might enter overbought territory.

Resistance level: 21700.00, 22025.00

Support level: 21375.00, 20970.00

Oil prices edged lower as investors booked profits ahead of OPEC+’s decision on production cuts. A larger-than-expected draw in US crude stockpiles provided some support, with the Energy Information Administration reporting a significant drop in inventories as refiners ramped up operations. Nonetheless, gains were muted amid uncertainty over OPEC+’s policy direction.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Niveau de résistance : 70,40, 72,55

Support level: 68.05, 65.65

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.