-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

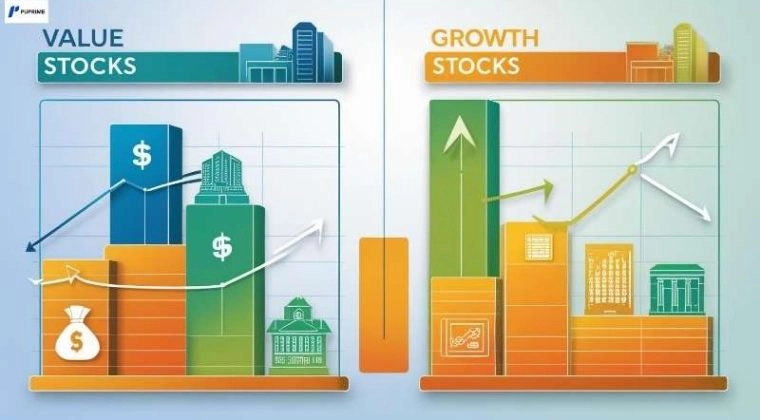

When investing in the share market, one of the first major decisions you’ll face is whether to back value stocks or growth stocks.

These two types of shares behave quite differently, and understanding how they work can make a difference to your long-term strategy.

Put simply, value stocks are usually tied to stable companies that might be trading below what they’re actually worth.

Growth stocks are linked to companies aiming to expand quickly, often reinvesting profits to chase bigger returns later.

Both have their place in the market, and depending on the economy’s performance, one might appeal more to your investment portfolio than the other.

In this article, we’ll break down what each stock type looks like, how they perform under different conditions, and what kind of investor each style tends to suit.

Value stocks are shares in companies that look underpriced compared to their actual financial performance.

They tend to come from well-established businesses with consistent earnings and a long track record of stability.

These stocks often have lower price-to-earnings (P/E) ratios, which can be a sign that the market isn’t fully recognising their underlying value.

Investors who go for value stocks are usually looking for something reliable, like solid companies that generate profits, pay dividends, and aren’t chasing huge expansion plans.

These shares are often found in sectors like energy, financials or consumer goods.

Think supermarkets, banks, or utility companies.

A significant aspect of value investing is the concept that the market will eventually reflect the intrinsic value.

If a stock is trading below its intrinsic value based on the company’s actual numbers, patient investors may see a price rise over time as the gap closes.

Growth stocks are tied to companies that are expected to expand quickly.

They might be building new products, entering new markets, or scaling up operations.

These companies usually reinvest their profits to fuel that growth, so they often don’t pay much (if anything) in dividends.

Because of this forward-looking approach, growth stocks usually have higher P/E (price to earnings) ratios.

Investors are betting on future earnings, not what the company is making today.

That means these stocks can look expensive compared to their current performance, but the potential for returns is higher if the company delivers.

Tech companies are a typical example here.

Think of businesses in software, e-commerce, or biotech sectors where innovation moves fast and success can scale quickly.

The upside of growth investing is clear: when it works, the returns can be substantial.

But if a company misses expectations or the economy turns, growth stocks can also fall sharply.

They tend to be more sensitive to interest rate hikes and changes in investor confidence.

| Feature | Value Stocks | Growth Stocks |

| Primary Focus | Undervalued companies with stable earnings | Companies expected to grow quickly |

| Typical P/E Ratio | Lower | Higher |

| Dividend Payments | Often pay regular dividends | Rare or none (profits reinvested) |

| Price Movement | Slower, more stable | Higher potential for rapid gains |

| Common Sectors | Financials, Energy, Consumer Staples | Tech, Healthcare, Consumer Discretionary |

| Investor Mindset | Income-focused, value-seeking | Growth-focused, future-oriented |

| Risk Level | Generally lower | Generally higher |

| Cash Flows | More predictable | Less predictable, more potential |

Over the past five years, the battle between growth and value stocks in the US has been a bit of a rollercoaster.

From 2020 to 2021, growth stocks, especially in tech, pulled well ahead, thanks to low interest rates, strong earnings, and a lot of investor excitement around innovation.

That momentum peaked in 2023, when growth stocks jumped 38.5% while value stocks rose just 12%, driven largely by major players like Nvidia, Apple, and Tesla.

But the picture shifted in 2022.

As inflation rose and the Federal Reserve hiked interest rates, growth stocks took a big hit, dropping 36.7%, while value stocks held up much better, slipping only 0.7%.

That year showed how sensitive growth stocks can be to rate changes, while value sectors like energy and financials stayed relatively steady.

In early 2024 and into 2025, value stocks have had a few strong runs, including rallies in Q1 2024 and January 2025, led by sectors like financial services, energy, and healthcare.

Still, growth stocks continue to lead overall.

They’ve outperformed in four of the last five years, especially when the market’s been rising.

That said, when things get volatile or interest rates climb, value stocks have shown they can hold their ground and offer a layer of protection.

There’s no one-size-fits-all answer.

The right choice depends on your financial goals, your time frame, and how much risk you’re comfortable with.

Many investors choose to hold both.

That way, their portfolio is better positioned to handle shifts in the market, interest rates, or economic growth.

If you don’t want to pick individual stocks, mutual funds and ETFs (exchange-traded funds) offer a simpler way to invest in value or growth strategies.

These funds group many stocks into a single product, giving you broader exposure with one investment.

For example, a value-focused ETF might hold banks, energy companies, and consumer brands with strong fundamentals and low P/E ratios.

A growth ETF might include tech stocks, innovative startups, or firms expanding into new global markets.

One benefit is diversification.

Rather than putting all your money in one company, you’re spreading your risk across dozens (or hundreds) of shares.

Many of these funds are also passively managed, meaning they track an index rather than trying to beat the market, which helps keep fees low.

Whether you prefer active or passive management, mutual funds and ETFs make it easier to stick with a style that suits your goals.

The economy plays a significant role in how value and growth stocks perform.

When interest rates rise, growth stocks tend to struggle more.

Their future earnings become less valuable when borrowing costs increase, and the market gets more cautious about paying high prices for unproven growth.

Value stocks, especially those with solid balance sheets and stable income, can hold up better in these conditions.

Investors often see them as safer places to park their money during uncertain times.

Inflation, interest rate changes, and consumer confidence can all affect how each style performs.

That’s why many investors build a mix of both into their portfolios, adjusting as economic conditions shift.

As we head further into 2025, the outlook for value and growth stocks in the US is being shaped by shifting interest rates, high share prices, and changing market trends.

With central banks starting to lower rates, growth stocks could see a boost, and lower rates make their future earnings more valuable on paper.

But it’s not quite that simple.

While growth stocks, especially in tech, have been the big winners over the past decade, value stocks have held up better during tough times like market dips or rate hikes.

Right now, valuations are a big talking point.

Growth stocks are still trading at high prices compared to value stocks, which could become a problem if investor enthusiasm fades or policy changes don’t deliver as expected.

In contrast, value stocks are looking relatively cheap; in fact, the gap between value and growth prices is as wide as it’s been since the 1990s.

That’s why some investors are starting to shift towards value sectors like energy, financials, and industrials in early 2025, looking for more stability and diversification.

Looking ahead, growth stocks may continue to do well if rates fall and the market stays optimistic.

But with high prices and heavy focus on a few big names, they come with risk.

Value stocks might not have the same excitement, but they offer a buffer during market wobbles, and could benefit if investors start looking beyond just tech.

The bottom line?

There’s room for both, but keeping an eye on the broader economy and staying balanced could be key for what comes next.

Understanding the difference between value and growth stocks gives you more confidence in shaping your investment plan. Value stocks tend to offer stability and income.

Growth stocks focus on long-term potential, often with higher risk.

Markets shift. So do strategies. The key is building something that fits your needs, your timeline, and your comfort with risk. You don’t need to pick sides – often, the best results come from holding a bit of both.

With PU Prime, you can access a wide range of stock CFDs across both styles.

Explore opportunities in tech, energy, finance and more, all through one platform, practising in a demo account, and then start trading live when you’re ready.

1. Are value stocks safer than growth stocks?

They tend to be less volatile because they’re tied to stable companies with consistent earnings. But all investing involves risk, and value stocks can still fall in price.

2. Do growth stocks always outperform over time?

No. They can deliver strong returns, especially during bull markets or periods of low interest rates, but value stocks have outperformed in other conditions.

Performance depends on timing and the economy.

3. Can I invest in both value and growth stocks?

Yes. Many investors combine the two to diversify their portfolios and reduce overall risk.

4. How do interest rates affect value and growth stocks?

Higher rates usually put more pressure on growth stocks, since they rely on future earnings.

Value stocks often hold up better when borrowing costs rise.

5. What’s the easiest way to get started?

Mutual funds or ETFs focused on value or growth are a straightforward way to invest.

They offer diversification, professional management, and easy access through most trading platforms.

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.